There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

CA Articleship Interview is a crucial milestone in the journey of becoming a Chartered Accountant. It marks the transition from classroom learning to real-world professional exposure. During this phase, students develop hands-on experience in areas such as accounting, auditing, and taxation. Although the articleship interview may initially appear daunting, proper preparation can make the process far more manageable. Being familiar with the commonly asked CA Articleship Interview questions helps students prepare effectively and significantly boosts their confidence when facing the interviewer.

Why Preparing for CA Articleship Interview Matters?

Preparation plays a key role in succeeding in a CA Articleship Interview, as it helps you know what to expect and how to respond confidently. Firms generally prefer candidates who show a genuine willingness to learn and maintain a positive, professional attitude toward work. They also expect a sound understanding of fundamental concepts in accounting, taxation, and auditing. By revising the important topics for the CA Articleship Interview, you can respond to questions with clarity and confidence. Thorough preparation reflects your seriousness about the opportunity and your readiness to take on responsibilities. Going into the interview well-prepared not only reduces nervousness but also enables students to present their knowledge, skills, and personality more effectively.

Important Topics for CA Articleship Interview

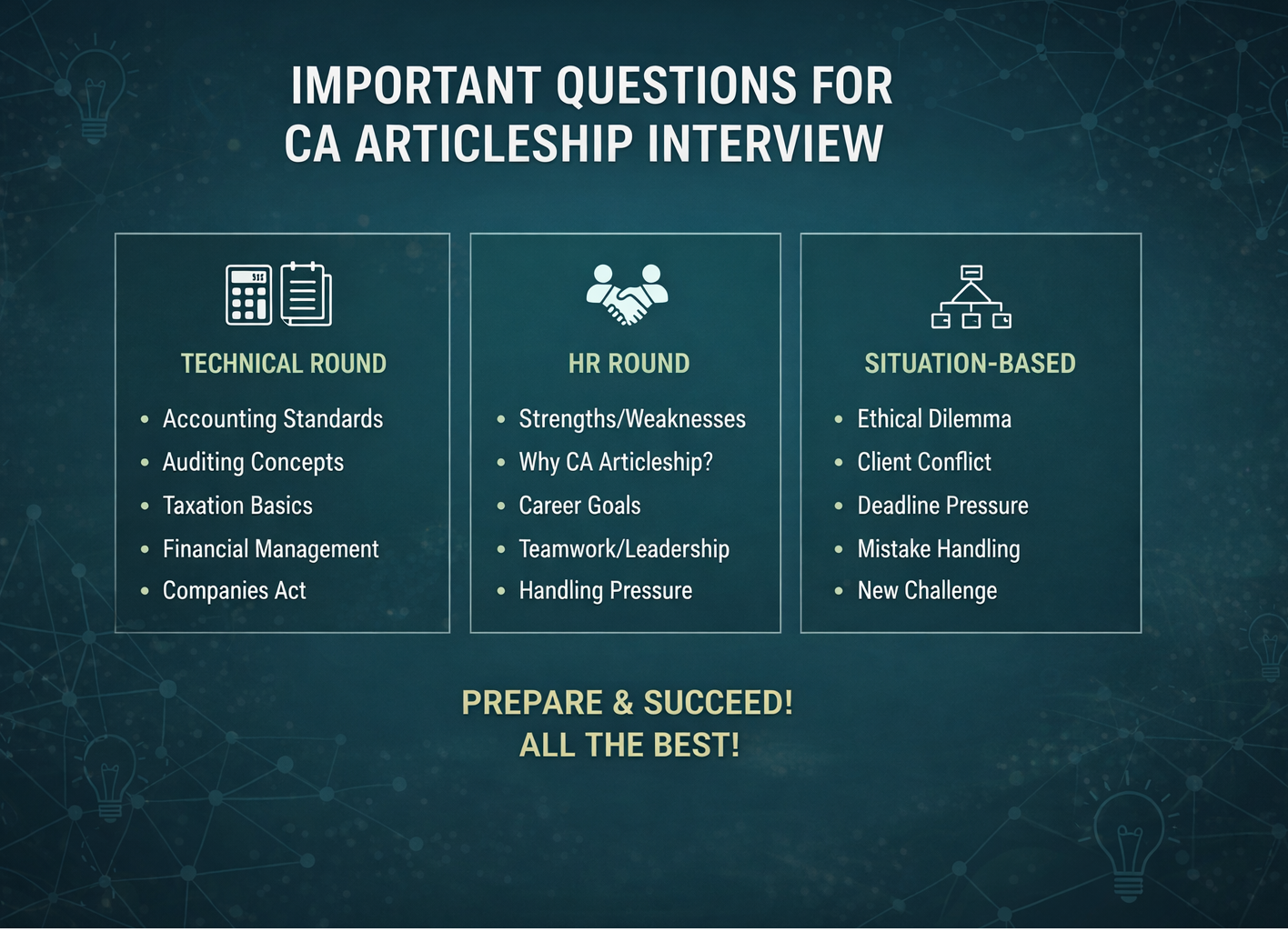

Prior to the CA Articleship Interview, all students should review key concepts. Accounting standards, the fundamentals of taxes, auditing practices, and general knowledge of ICAI updates are some of these ideas. Businesses may ask behavioral questions in addition to technical ones to gauge your ability to think and react in real-world scenarios. The list of crucial subjects for the CA Articleship Interview is provided below in straightforward categories.

| Important Topics for CA Articleship Interview | |

|---|---|

| Area | Topics You Should Revise |

| Accounting | Accounting Standards, Deferred Tax, Capital vs Revenue Expenditure |

| Auditing | Definition, Objectives, Vouching, Verification, Audit Report |

| Taxation | GST basics, Direct vs Indirect Taxes, TDS, Filing of Income Tax Return |

| General Knowledge | ICAI updates, Latest changes in law, Finance-related news |

| Personal & Behavioral | Strengths, Weaknesses, Teamwork, Handling mistakes, Career goals |

Most Common Questions for CA Articleship Interview

Interviewers generally ask a mix of personal, HR, technical, and situational interview questions to evaluate a CA aspirant’s overall suitability. Below are the important categories along with commonly asked examples:

A) Personal and HR Interview Questions

B) Technical Interview Questions During a CA articleship interview, candidates are often tested on their technical knowledge of accounting, taxation, and auditing. Below are some commonly asked technical interview questions for CA students:

C) Situational and Behavioral Interview Questions

In a CA articleship interview, situational and behavioral questions are asked to understand how a candidate reacts to real-life work scenarios. These questions reflect a student’s professional attitude, problem-solving ability, and workplace behavior. Commonly asked situational and behavioral interview questions for CA articleship include:

Tips to Answer Questions Effectively

Answering questions in a CA Articleship interview requires a combination of practice, confidence, and conceptual clarity. It is not enough to simply know the correct answer; candidates must also present it in a clear, structured, and professional manner. Below are some practical tips that can help you perform better during your interview.

While answering interview questions, ensure your response is clear, concise, and easy to understand. Avoid using complicated terminology or unnecessarily long sentences, as this may confuse the interviewer. A well-structured answer reflects clarity of thought and good communication skills.

Interviewers prefer answers that connect theoretical knowledge with real-life situations. When asked about teamwork, time management, or handling pressure, try to share relevant examples from college projects, internships, or exam preparation. This shows your ability to apply concepts in practical scenarios.

It is normal to face questions you may not know. In such situations, do not panic or guess blindly. Politely admit that you are unsure and express your willingness to learn the concept later. Honesty and a learning attitude are highly valued in a CA articleship interview.

Firms do not expect students to have in-depth knowledge of advanced topics. However, they do expect strong clarity in basic concepts of accounting, auditing, and taxation. Revising fundamentals before the interview can significantly boost your confidence.

Articleship is primarily a training period, and firms look for candidates who are eager to learn. While answering questions, reflect a positive attitude, openness to guidance, and readiness to take responsibility. This reassures the interviewer about your long-term potential.

Avoid sharing excessive personal information. Instead, focus on academics, career goals, technical skills, and professional interests. This helps create a serious and mature impression.

Confidence improves with practice. Prepare common CA articleship interview questions and practice answering them aloud, either in front of a mirror or with a friend. This reduces hesitation, improves fluency, and helps you deliver answers smoothly during the actual interview.

In addition to testing academic knowledge, a CA Articleship interview assesses your self-assurance, discipline, attitude, and eagerness to learn. You can greatly enhance your performance by reviewing the key points for the CA Articleship interview and practicing frequently asked questions. Employers look for students that are sincere, committed, and motivated to advance. You may make a good impression and start down the path to a prosperous career in chartered accountancy with the correct preparation and a positive outlook.