There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

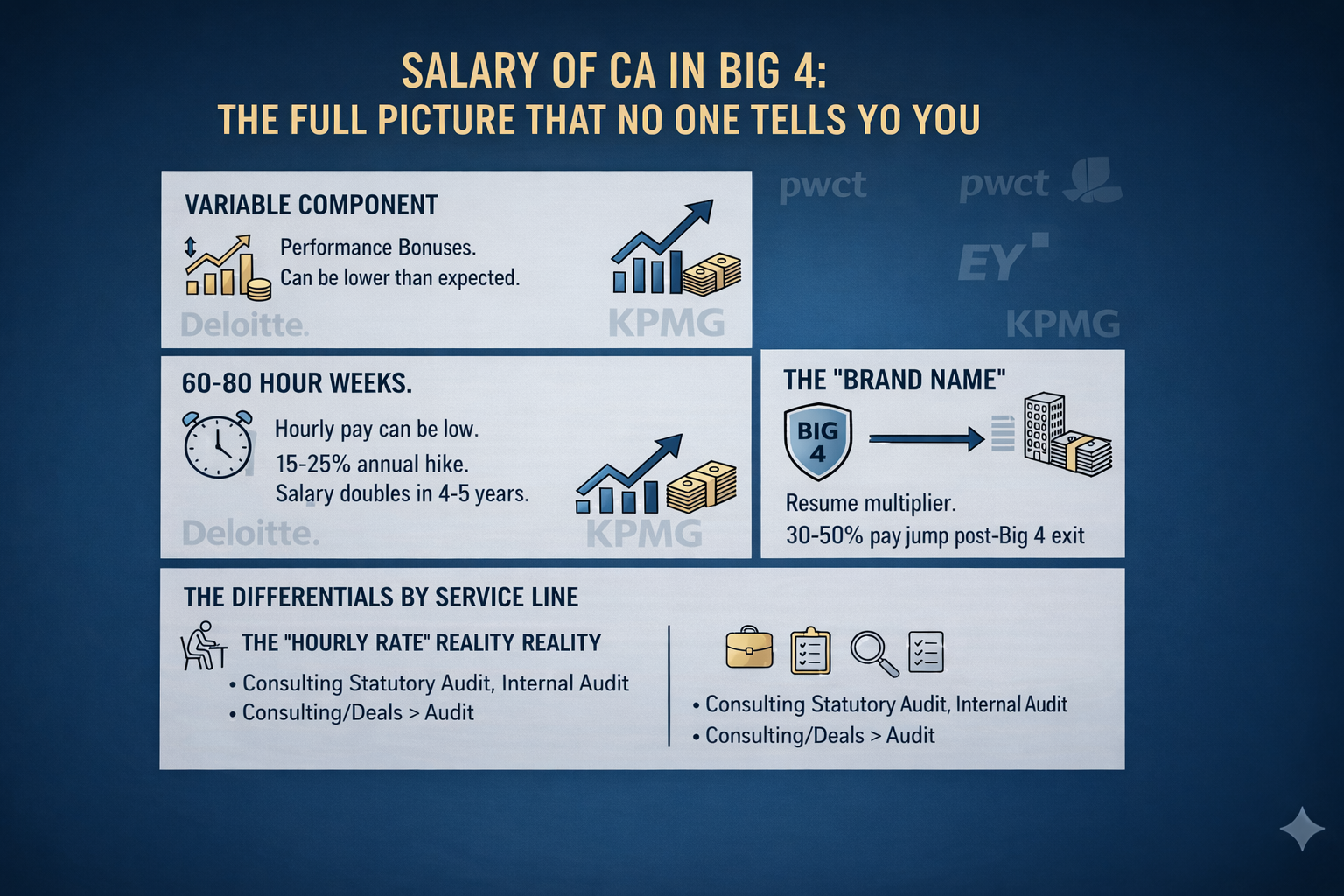

If you’ve recently qualified as a Chartered Accountant—or are on the verge of clearing your CA Final exams—the Big 4 firms in India are likely already on your shortlist. Deloitte, EY, PwC, and KPMG aren’t just employers; they’re global brands that carry immense credibility in the finance and consulting world. For many newly qualified CAs, joining a Big 4 firm feels like the natural next step after earning the hard-won “CA” prefix.

But the real question remains: how much does a CA actually earn in the Big 4?

There’s no shortage of opinions. Some claim the pay is exceptional, while others argue it’s overrated given the workload. With so much mixed information, separating hype from reality becomes difficult.

This guide aims to cut through that noise. It offers a realistic, fresher-level breakdown of a CA’s salary in the Big 4, grounded in 2025 market trends and practical industry experience—so you know exactly what to expect before you step in.

What Is the Starting Salary of CA in Big 4?

Let's get right to it. The starting compensation for a newly qualified Indian CA joining the Big 4 is normally between ₹8.5 lakh and ₹12 lakh annually. Based on actual offers and ICAI campus placement data, this Big 4 CA fresher package range was created.

Here's a brief overview of the Big 4 CTC structure by department:

| DEPARTMENT | APPROXIMATE CTC (ANNUAL) |

|---|---|

| Statutory Audit | ₹8.5 to ₹9.5 LPA |

| Direct / Indirect Tax | ₹9 to ₹10.5 LPA |

| Risk Advisory / Internal Audit | ₹9 to ₹11 LPA |

| Deals / Transaction Advisory | ₹11 to ₹12 LPA |

This graphic is a good starting point if you're curious how much a CA makes at Deloitte or EY.

Your city (Delhi and Mumbai frequently provide better packages), communication abilities, and whether your articleship matched the profile you're applying for will also affect your offer.

Do CA Rank Holders Earn More in Big?

Yes, but there isn't much of a difference.

If you possess a rank, you might be able to obtain premium positions like International Tax, Valuations, or Deals in India's Big 4 organizations, or you might make between ₹1 and ₹1.5 LPA more than the typical package. Non-rankers can, however, be placed on an equal footing with the help of effective communication skills, real-world experience gained during an articleship, and a keen professional approach.

Therefore, even though Big 4 companies might theoretically pay rank holders a little more, in practice, it's your abilities, performance, and experience that really matter.

Career Growth: Salary Hike in Big 4 After Joining

The Big 4's CA salaries are always changing. In the Big 4, promotions usually occur every one to two years and come with a consistent pay increase.

This is an example of a common growth path:

| ROLE | EXPERIENCE | EXPECTED SALARY |

|---|---|---|

| Associate | 0–1 year | ₹9–10 LPA |

| Senior Associate | 1–2 years | ₹12–14 LPA |

| Assistant Manager | 2–4 years | ₹16–20 LPA |

| Manager | 4–6 years | ₹22–30 LPA |

| Senior Manager | 6–9 years | ₹30–40+ LPA |

| Director / Partner | 10+ years | ₹45–60+ LPA |

Therefore, the long-term benefits speak for themselves if you're asking if it's worthwhile to join the Big 4 after California.

Beyond the monthly salary, a CA role at Deloitte, EY, KPMG, and PwC offers several additional benefits. These include annual performance bonuses ranging from 10% to 20%, reimbursement for professional certifications such as CFA or CPA, comprehensive corporate health insurance, and paid travel expenses for client assignments. Some teams also provide hybrid work options. Collectively, these benefits significantly enhance the overall compensation and make a Big 4 CA salary more competitive in the long run.

But Let’s Be Real: It’s Not Easy

Big 4 work is not easy, and it comes with its own challenges. During peak seasons, workdays often extend to 10–12 hours. Fresh joiners may not always get their preferred department, especially if they do not hold a rank. Roles in audit and advisory frequently involve travel, and maintaining work-life balance can be difficult in the initial years. However, for those who are focused, disciplined, and resilient, this phase builds a strong professional foundation and prepares them for high-growth roles in the future.

Where Do You Go After 2–3 Years in Big 4?

Even if the initial CA fresher package at a Big 4 firm seems modest, the real value lies in long-term career growth. After gaining 2–3 years of experience, professionals often transition into roles such as Finance Manager positions in multinational companies, Investment Banking or Private Equity, international assignments in locations like Dubai, Singapore, or London, the CFO track in startups, or roles within government and regulatory bodies such as SEBI and RBI. With the right exposure and smart career moves, a ₹9 LPA package today can grow into ₹20+ LPA within a few years by effectively leveraging Big 4 experience.

What is the salary of a CA fresher in Big 4 firms?

A CA fresher typically earns between ₹8.5 to ₹12 LPA, depending on the department, location, and role offered.

How does the Big 4 salary compare with other CA jobs?

While the starting pay may be slightly lower than some niche finance roles, the exposure, learning curve, and career acceleration in Big 4 firms often outweigh the initial difference.

Is it worth joining a Big 4 firm after CA?

Yes. Big 4 firms offer strong learning opportunities, excellent networking, and long-term career growth, making them a solid choice for fresh Chartered Accountants.

Do CA rank holders receive a higher salary in Big 4 firms?

Yes, but the difference is usually limited to around ₹1–1.5 LPA. Candidates with strong communication skills and quality articleship experience can easily bridge this gap.

What are the components of a Big 4 CA salary package?

The CTC generally includes a fixed base salary, performance-linked bonus, possible joining bonus, and additional benefits such as insurance and allowances.

Final Thoughts: Is salary of CA in Big 4 worth?

If your only goal is a high starting salary, there may be other roles that offer better pay in the first year. However, if you’re looking for an exceptional learning curve in finance, hands-on client exposure, and a powerful brand name that opens doors, Big 4 firms stand out. The salary of a CA in Big 4 may appear modest initially, but the long-term career value it creates is immense. It acts as a launchpad to senior roles, better locations, and global opportunities. So yes—joining a Big 4 firm after qualifying as a CA is absolutely worth it, provided you enter with realistic expectations, a strong learning mindset, and the drive to grow.